There is always the emphasis that people should include savings in their budgets. In fact, financial advisers recommend that this should be a priority. Unfortunately, people plan other expenditures first and hope to save any money that will remain. Saving is important since it promotes financial independence in many ways. Notably, people who are serious about saving do not face a lot of financial challenges. If you have not been saving, the time is now. The insights below will motivate you to start saving today.

Setting Future Goals

Most life goals require finances. It is not possible to set them if there is no money allocated to them. Financially wise people start saving as early as now for future plans that are even 10 years in the future. Whether you are saving for school fees for your kids, buying a home or any other goals, the money you set aside for it today will make this dream a reality. People who consume all their money but still have future goals may have a hard time trying to fulfill their goals. The set time will arrive, but there will be no money available to finance such projects.

Life Without Loans

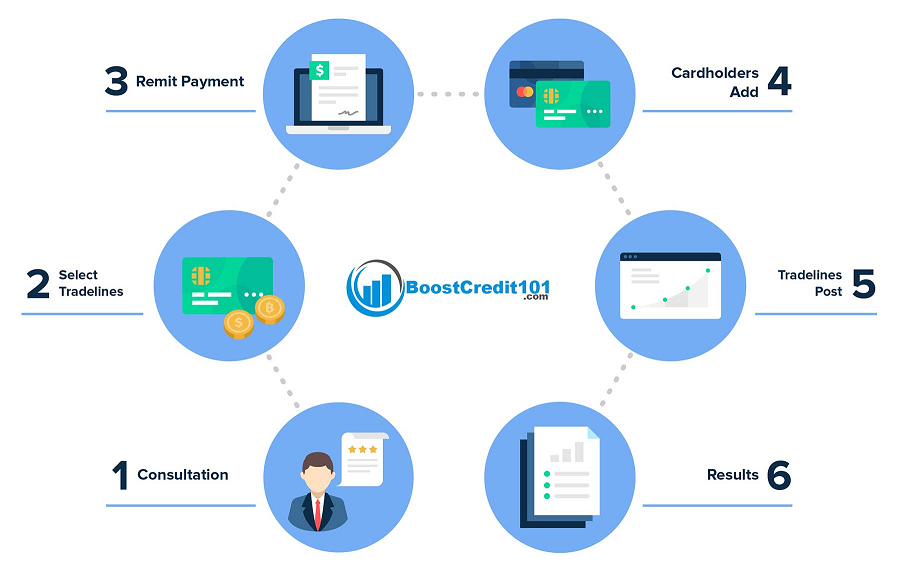

People take out loans because they do not have money to meet a pressing need. As mentioned above financial needs like school fees, money to buy a house and other future needs may force you to take out a loan with a high interest rate. This increases the chances of defaulting or making late payments and consequently lowering your credit score. Even though it is possible to raise your score again as guided by https://www.boostcredit101.com/, the damage can affect you for years to come. However, those who save will not go through the process of repaying loans and will not incur interest costs. They will simply execute their plans with ease.

Taking Care of Emergencies

Accidents, sickness, calamities, and other emergencies are part of life. No one knows when they will strike and the extent to which they will affect people. They require money, and some even cost millions. Luckily, a person with the habit of saving rarely encounters challenges at such a time like a person who does not save. It is better to have some savings even if the emergency will cost more than what you have saved. If you will have to look for more money, the burden will be partly solved. Get into the habit of saving for any emergency that can develop in life.

Investing

Investment is one way of moving yourself to financial independence. It will work better if you choose a good investment plan and finance it with saved money rather than borrowed cash. There are numerous people who are saving to get started in businesses, which is an excellent idea. If such an investment collapses, which is a possibility anyway, one will lose what had been saved rather than having a loan that must be repaid fully.

Conclusion

There is no doubt that saving is the most excellent way to be financially stable. Before heading to a lender to apply for a loan, ask yourself if there is any other way to go about it. Only pressing emergencies should force you to take out a loan. From the above insights, there are more than enough reasons to start saving.