Not sure what all those things mean on your pay stub? Learn about net pay vs. gross pay, FICA and other details you should know about how to read your paystub.

When you get your paycheck each week, there’s one thing you can count on. The amount you get to keep is always less than the amount you earned.

Why is this? Have you ever wondered?

Well, the difference between the amount you get to keep and the amount you earn is the net pay vs. gross pay.

The gross pay is the amount you earn, while the net pay is the amount you keep.

How do employers calculate this, though? Why don’t they give you all your earnings?

If you are wondering why this happens and where the difference comes from, keep reading. Here is an explanation of what all of this means.

The Difference Between Net Pay vs. Gross Pay

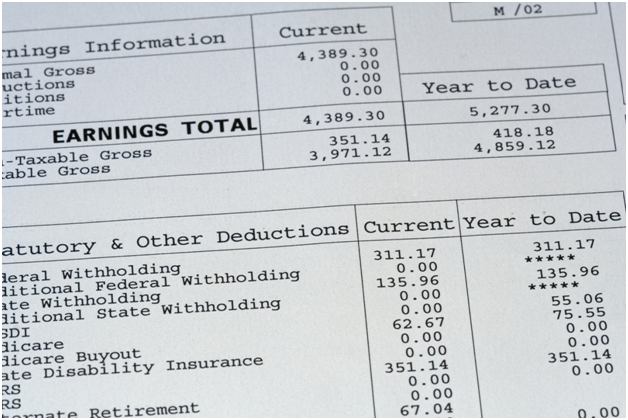

Gross pay is often the first thing you will see on your pay stub. The gross pay refers to the total amount of income you earned during the pay period.

If your pay period is for one week, the gross pay shows the amount you earned for that week. If the pay period is bi-weekly, gross pay shows the amount of income for two weeks of work.

The net pay, on the other hand, is the amount you receive in the form of a paycheck.

Your net pay is the amount you receive after your employer takes all the withholdings and deductions from your earnings.

To summarize, gross pay is the amount you earned for the period. Net pay is the amount you keep. Your pay stub shows your gross pay and net pay and the way your employer calculated these amounts.

The Definition of Withholdings and Deductions

The two things that make up the difference between the amount you earn and keep are withholdings and deductions. So, what are these things?

Withholdings: What They Are and the Types You Might See on Your Check

Withholding is an expense you must pay from your paycheck that you cannot control. The most common type of withholding is taxes. Your pay stub will reflect all the taxes that your employer takes from your check.

Here are some examples of withholdings you’ll probably see on your stub:

- Federal taxes – Most employers must pay taxes to the federal government, and that is the purpose of this withholding.

- State taxes – You’ll also see a line for state taxes your employer withholds, and these go directly to the state where you work.

- Local taxes – Local taxes refer to county taxes, and this is another expense you’ll have to pay when you earn money.

- FICA – You’ll also notice a line for FICA taxes. You pay these to contribute to the government’s Medicare and Social Security programs.

Paying taxes is a requirement for all eligible employees in this country, and there is nothing you can do to stop paying these.

Deductions: What They Are and the Types You Might See on Your Check

A deduction is typically something you voluntarily pay for from your earnings. You may not have any deductions on your check, or you might have some. Here are some examples of typical deductions on a pay stub:

Health Insurance Premiums

If your employer supplies you with health insurance, you might have to pay a portion of the premiums.

When you enroll in an employer-sponsored plan, you would know the amount you are responsible for paying. Whatever this amount is will show up on your pay stub each pay period to indicate that you paid your part of the premiums.

Retirement Fund Contributions

If you take part in contributing to an employer-sponsored retirement fund, you’ll see a deduction for this, too. For example, suppose you decide to contribute $100 each paycheck. Each time you get paid, you’ll see a deduction for $100 for this purpose.

Garnishments and Other Deductions

If you have a judgment against you or are required to pay child support or alimony, you might see deductions for these things. While these are not voluntary, your employer must withhold them if there is a court order to do so.

Earnings Minus Withholdings and Deductions Equal Net Pay

After your employer calculates all the expenses they must deduct from your paycheck, they use a formula to find the net pay.

The formula works like this:

Gross Pay – Deductions and Withdrawals = Net Pay

How Employers Calculate the Amounts on Your Pay Check

To understand this even further, you might want to know how employers calculate all these things. There are several methods that companies use for this purpose.

One, they may use a software program. You can purchase software for financial, tax, and accounting purposes. When you have the right software, it’s easy to calculate the withholdings and deductions.

To do this, the employer will set up a profile for each employee. The profile would include information about the person’s income, withholding rates, and deductions, and every employee would have one.

On payday, the employer must generate paychecks by running the program. The program does all the work.

Another option is a paycheck stub generator. This option provides another simple method to calculate gross pay and net pay for each employee.

When your employer withholds money for taxes or other deductions, they do not keep this money. Instead, your employer sends it to the appropriate places.

If they deduct money for taxes, your employer sends them to the necessary tax authority.

If the money is for child support, they send it to the courthouse. The money withheld is not for your employer to keep. It’s for them to pay expenses for you.

Explore More Information on This Topic

Hopefully, you now understand the difference between net pay vs. gross pay.

If you are interested in learning more about the way employers calculate these things, or print pay stubs for their employees, check out our blog.

You’ll find helpful articles there about income, finance, business, and more.